Meet PayPrompt: Performance Pay That Actually Pays Off.

Managing payouts doesn’t have to be slow or confusing. PayPrompt automates commissions and incentives across teams and partners, giving you real-time visibility, reliable compliance, and the flexibility to adapt as your business grows.

What Is Performance Payout?

Beyond Traditional Rewards: Smart, Data-Driven Compensation

Performance payouts use real-time data to automatically reward your team based on what they actually achieve—sales numbers, customer satisfaction, or hitting key targets. Get instant, fair rewards that directly match the results your team delivers.

Why Performance Payouts Work Better

- Reward the right people at the right time Pay people immediately when they deliver results

- Test what works before you roll it out Try different incentive structures and see what drives better performance

- Pay for results, not just activity Your top performers get rewarded for the value they create

- See exactly where your money goes Track every payout with complete audit trails and full control

PayPrompt makes complex payout calculations simple and accurate.

Why PayPrompt outperforms Other Solutions

Most platforms try to handle payouts as an afterthought. PayPrompt was designed from day one to make performance payouts simple, accurate, and compliant.

Reward Platform

- Built for PayOps

- Custom Payout Logic

- Enterprise Compliance

- Real Time Visibility

- No

- Limited

- Often Missing

- Delayed Reports

- Built for PayOps

- Custom Payout Logic

- Enterprise Compliance

- Real Time Visibility

- Yes

- Limited

- Often Missing

- Delayed Reports

Nudge Management System

- Built for PayOps

- Custom Payout Logic

- Enterprise Compliance

- Real Time Visibility

- No

- Error-Prone

- Often Missing

- None

Key Features

No-Code Policy Configurator with vestion control

Multi-role Payout engine for sales agents, trainers, inspector & partners

Integration-ready (CRM, Partner Portals, Field Ops Tools)

Gamification-ready contest builder

Rule-based escalation workflows

Real-time dashboards for field, ops, and finance

Build Rules Your Way

Design payout rules around what matters to your business – products, regions, branch, channel, or any combination.Complete flexibility to match your unique needs.

Calculate Anything

Handle any payout structure you can imagine: bonuses, volume slabs, clawbacks, contest logics. If you can think it, PayPrompt can calculate it.

Test Before You Launch

Try new incentive plans in a safe test mode before rolling them out. Make data-driven decisions, not expensive guesses.

Adjust On-the-Fly

Change rules instantly when business needs shift. Whether it’s a new region, team restructure, or market conditions—adapt in real-time without delays.

Match Your Approval Process

Every business runs differently. Set up approval workflows that match how your company actually operates, not how software thinks you should.

Smart Payment Controls

Automatic compliance checks and documentation requirements before any payment goes out. Protect your business while keeping payouts flowing.

Never Miss a Deadline

Smart scheduling handles holidays, escalations, and time-sensitive approvals automatically. Your team gets paid on time, every time.

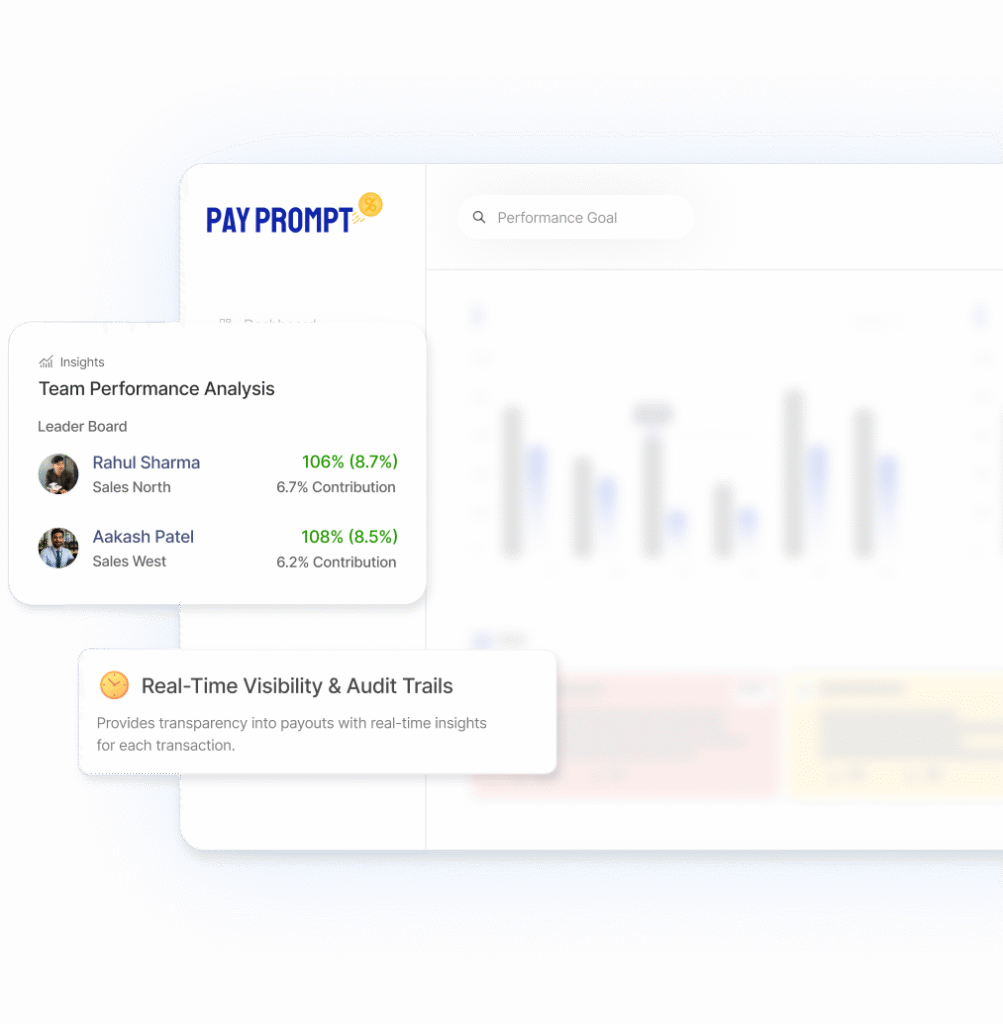

See Everything, Track Everything

Complete visibility into every calculation, approval, and payment. Full audit trails mean you can answer any question about any payout, anytime.

Everyone Wins with PayPrompt

Built for both Finance and Business teams PayPrompt gives Finance real control while helping Business teams move faster. Both sides get what they need without compromise.

For Finance Teams

Control that actually feels like control — minus the Excel headaches.

See Every Rupee's Journey

Track exactly where your money goes and why, because “trust me” isn’t a financial strategy.

Turn Approval Chaos into Process

Replace scattered signatures with streamlined workflows. Faster, compliant approvals that keep business moving.

Make time for what matters

Automated calculations and validations free up your time for strategic work instead of manual number-crunching.

For Business Leaders

Performance tools that think as fast as your business moves.

Build Incentives Like Strategy

Design payout rules that reflect your goals, and launch them faster than traditional review cycles.

Give your team clear visibility

Show your team exactly how their performance translates to rewards and how they compare to their peers.

Test and Optimize without Risk

Try different incentive approaches safely, measure the impact, and scale what works while dropping what doesn’t.

For Finance Teams

Control that actually feels like control — minus the Excel headaches.

See Every Rupee's Journey

Track exactly where your money goes and why, because “trust me” isn’t a financial strategy.

Turn Approval Chaos into Process

Replace scattered signatures with streamlined workflows. Faster, compliant approvals that keep business moving.

Make time for what matters

Automated calculations and validations free up your time for strategic work instead of manual number-crunching.

For Business Leaders

Performance tools that think as fast as your business moves.

Build Incentives Like Strategy

Design payout rules that reflect your goals, and launch them faster than traditional review cycles.

Give your team clear visibility

Show your team exactly how their performance translates to rewards and how they compare to their peers.

Test and Optimize without Risk

Try different incentive approaches safely, measure the impact, and scale what works while dropping what doesn’t.

PayPrompt For Industries That Move Fast

Sales and Collections

Unlocking efficiencies in performance based payouts for Sales & Collections.

Osian builds products that solve operational and engagement challenges for distributed workforces. Our flagship product, PayPrompt, empowers lending institutions to manage performance-linked payouts at scale. The solution is

designed for the unique needs of sales (employees, DSTs, DSAs) and collections (employees, agencies, call centers, DDSAs) and brings automation, flexibility, and insight to your variable pay programs.

Insurance

Unlocking efficiencies in performance-based payouts for Insurance Sales, Renewals, Claims Operations & Inspections

Osian builds products that solve operational and engagement challenges for distributed workforces. Our flagship product, PayPrompt, empowers insurance companies to manage performance-linked payouts at scale. The solution

is designed for the unique needs of insurance sales (agents, advisors, channel partners, banca channels) and claims/pre-insurance inspections, bringing automation, flexibility, and insight to your variable pay programs.

Fintech

Unlocking efficiencies in performance-based payouts for Sales Agents, Trainers, Field Inspectors & Channel Partners.

Osian builds products that solve operational and engagement challenges for distributed workforces. Our flagship product, PayPrompt, empowers fintech and equipment sales companies to manage performance-linked payouts at scale. The solution is designed for the unique needs of sales agents, trainers, field inspectors, and channel partners bringing automation, flexibility, transparency and insight to your variable pay programs

Pharma

Make medical rep incentives as precise as your formulations. In pharma, every interaction counts and every payout needs audit-ready transparency. PayPrompt automates the complex fusion between territory management, product sampling, and revenue attribution.

Osian builds products that solve operational and engagement challenges for distributed workforces. Our flagship product, PayPrompt, empowers pharmaceutical companies to manage performance-linked payouts at scale. The solution is designed for the unique needs of medical representatives (MRs) and sales agents handling channel sales, bringing automation, flexibility, and insight to your incentive programs.

PayPrompt For Industries That Move Fast

Lending

Lending moves at the speed of opportunity. PayPrompt ensures channel partners and DSA incentives keep pace with business needs, with real-time transparency that keeps everyone aligned.

Sales Team

Channel partners see exactly how their efforts translate to earnings. Clear incentives and instant payouts mean better loan quality and faster turnaround.

Collection Team

Recovery teams get smart, rule-based incentives that reward efficient collection strategies. Real-time tracking and audit-ready records make compliance effortless.

Insurance

Insurance thrives on trust and transparency. PayPrompt manages complex multi-channel incentive structures while ensuring every payout meets regulatory standards and drives the right behaviors.

Sales Team

Insurance agents see clear commission structures and understand exactly how different policies impact their earnings. This transparency helps them focus on the right opportunities and build sustainable client relationships.

Collection Team

Recovery teams work with automated incentive systems that track compliance requirements. Real-time performance data helps them improve collection efficiency while meeting all regulatory standards.

FMCG

PayPrompt gives you real-time visibility into your distributor and channel partner ecosystems across multiple touchpoints. Streamline complex distributor incentives while maintaining clear oversight of channel partner performance.

Sales Team

Field sales teams get clear visibility into commission structures and rewards tied to actual performance. When earnings are transparent and real-time, territory coverage becomes strategic and results-driven.

Collection Team

Smart automated incentives make collection efficient and compliant. Rule-based recovery programs deliver faster renewals, complete audit trails, and compliance that supports performance instead of hindering it.

Pharma

In pharma, every interaction counts and every payout needs audit-ready transparency. PayPrompt handles the complex balance between territory management, product sampling, and revenue attribution.

Sales Team

Medical reps get clear visibility into how their territory activities drive earnings. Real-time performance data enables better detailing strategies, smarter secondary sales, and more effective collection approaches.

Collection Team

Automated incentive systems support faster policy renewals and payment recovery. Complete audit trails and real-time tracking satisfy compliance requirements while driving actual results.

Trusted By Industry Leaders

Tata Capital Transforms Customer Payments with PayPrompt

Tata Capital wanted to make payments faster and easier for their customers. By partnering with PayPrompt, they created a seamless payment experience that customers actually love using.

FAQs

PayPrompt is a workforce productivity and motivation platform that manages performance-linked payouts for partner agencies, field teams, call centre operations and gig workers. It ensures fast, transparent, and error-free incentive management, improving efficiency, compliance, and workforce motivation.

PayPrompt is built for businesses that rely on:

- Partner agencies (sales, collections, distribution)

- Gig and field workforce (delivery, micro-lending, on-ground sales)

Internal sales and operations teams managing complex payout rules

Traditional tools are rigid and focus mainly on end-of-month commissions. PayPrompt is:

- Flexible adapts to changing payout rules, business policies, and workforce models.

- Fast supports daily/weekly payouts instead of just monthly cycles.

- Engagement-focused integrates gamification and communication to motivate the workforce, not just calculate payments

- Handle Rewards and Recognition program along with other performance linked compensation plans to give a holistic view

Yes. PayPrompt supports:

- Multi-level hierarchies tailored to your organisation need (e.g., National → Regional → Zonal → Area → Rep)

- Business-rule-based payouts (performance, collections, SLAs, compliance)

- Variable payout frequencies (daily, weekly, monthly)

- Different payout models for different partners/teams within the same organisation

- Time and function based rules

- Manage target linked payouts

- Every payout is rule-based and traceable.

- Provides real-time reports and audit trails.

- Ensures regulatory compliance for financial institutions.

- Minimizes disputes by making incentive logic transparent.

PayPrompt connects seamlessly with:

- CRM & ERP systems

- HRMS & Payroll tools

- Payment gateways for disbursements

- Data warehouses and BI tools for analytics

- File based uploads

- API Based integration

Typical rollout is 4–6 weeks, depending on complexity. Since it’s plugin-ready and doesn’t require deep tech dependencies, most businesses can get started quickly.

Yes. PayPrompt is designed to handle:

- Multiple geographies

- Localized compliance requirements

- Currency and payout variations

- Instant & transparent payouts build trust.

- Gamification tools (leaderboards, badges, contests) drive engagement.

- Communication modules keep field teams aligned with goals.

- Results: lower attrition, higher productivity, and stronger performance.

On average, PayPrompt delivers:

- Reduction in payout errors (up to 90%)

- Faster payout cycles (days instead of weeks)

- Improved workforce retention

Higher productivity & collections through motivated teams

Yes. PayPrompt is built on enterprise-grade architecture:

- Scalable to handle thousands of transactions per day

- Secure with data encryption, access controls, and audit logs

Cloud-ready with redundancy and uptime guarantees

Have Questions? Let’s Talk.

Drop us your query and our team will get back to you promptly with the answers you need.