Simplify Payouts. Amplify Performance

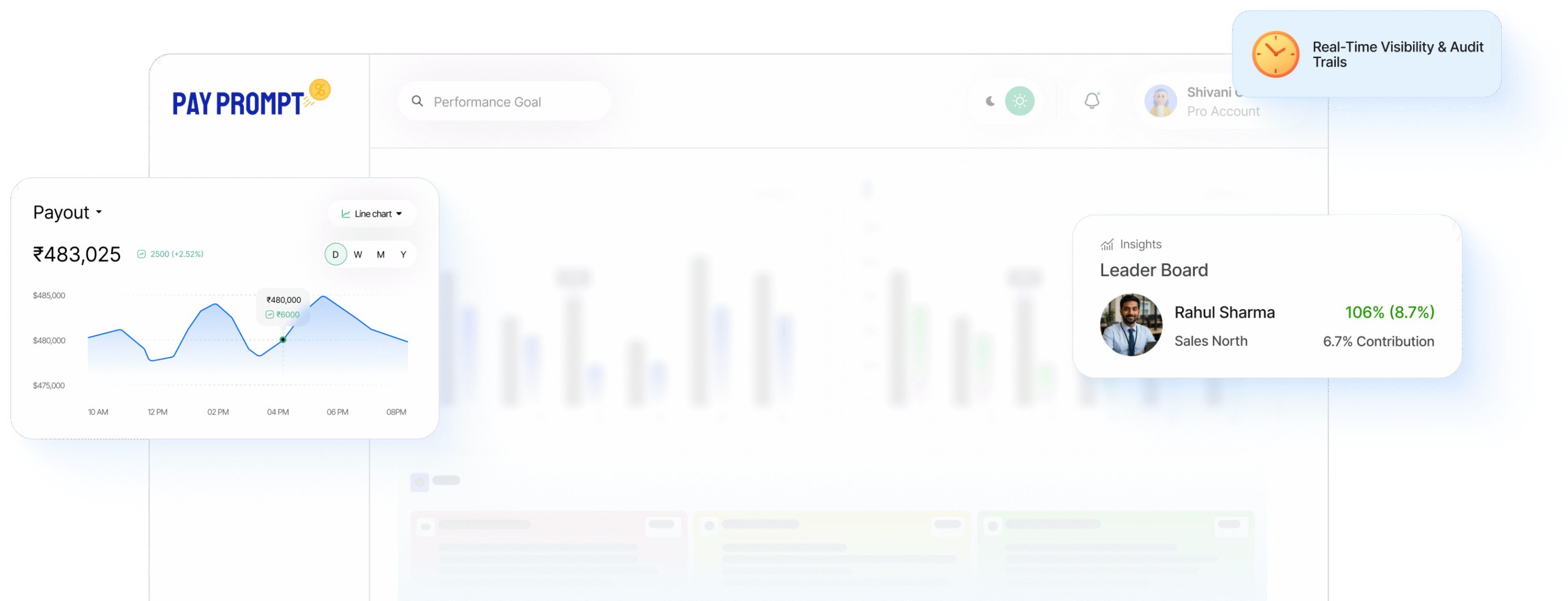

PayPrompt transforms how businesses with distributed teams manage performance payouts. By combining agile rule design, real-time visibility, and flexible automation, it transforms complex payout calculations into precise, comprehensive outcomes.

Trusted by Leading Enterprises

Simplify Payouts.

Amplify Performance

No more repetitive tasks or messy spreadsheets. With PayPrompt, payouts are automated, accurate, and transparent – giving your teams confidence in every payment and more time to focus on performance.

Automated Payouts

Ensure seamless and accurate payouts without repetitive manual work.

Adaptive Policies or Dynamic Policy Design

Easily adjust payout policies to match changing business goals and targets.

Real-Time Visibility

Track payouts instantly with complete transparency for every stakeholder.

Intuitive Rule Setup or DIY Rule Design

Design and modify payout rules through a simple, intuitive interface.

One Platform. Multiple Solutions OR A Connected Ecosystem for Growth.

Osian’s digital ecosystem brings together solutions that automate critical financial operations – from onboarding and KYC to lending and insurance workflows – helping businesses scale faster with efficiency and compliance.

Proven Impact. Real Results.

See how businesses of all sizes reimagined their payout operations with PayPrompt. From faster calculations to transparent processes, these stories highlight the measurable results achieved when payouts become seamless.

Tata Capital: Faster Payouts, Greater Agility with PayPrompt

Read More

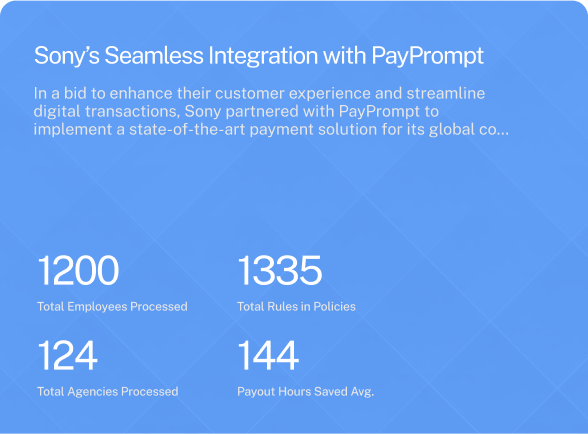

Sony: Driving Transparency and Scale in Payouts with PayPrompt

Read More

FAQs

PayPrompt is a workforce productivity and motivation platform that manages performance-linked payouts for partner agencies, field teams, call centre operations and gig workers. It ensures fast, transparent, and error-free incentive management, improving efficiency, compliance, and workforce motivation.

PayPrompt is built for businesses that rely on:

- Partner agencies (sales, collections, distribution)

- Gig and field workforce (delivery, micro-lending, on-ground sales)

Internal sales and operations teams managing complex payout rules

Traditional tools are rigid and focus mainly on end-of-month commissions. PayPrompt is:

- Flexible adapts to changing payout rules, business policies, and workforce models.

- Fast supports daily/weekly payouts instead of just monthly cycles.

- Engagement-focused integrates gamification and communication to motivate the workforce, not just calculate payments

- Handle Rewards and Recognition program along with other performance linked compensation plans to give a holistic view

Yes. PayPrompt supports:

- Multi-level hierarchies tailored to your organisation need (e.g., National → Regional → Zonal → Area → Rep)

- Business-rule-based payouts (performance, collections, SLAs, compliance)

- Variable payout frequencies (daily, weekly, monthly)

- Different payout models for different partners/teams within the same organisation

- Time and function based rules

- Manage target linked payouts

- Every payout is rule-based and traceable.

- Provides real-time reports and audit trails.

- Ensures regulatory compliance for financial institutions.

- Minimizes disputes by making incentive logic transparent.

PayPrompt connects seamlessly with:

- CRM & ERP systems

- HRMS & Payroll tools

- Payment gateways for disbursements

- Data warehouses and BI tools for analytics

- File based uploads

- API Based integration

Typical rollout is 4–6 weeks, depending on complexity. Since it’s plugin-ready and doesn’t require deep tech dependencies, most businesses can get started quickly.

Yes. PayPrompt is designed to handle:

- Multiple geographies

- Localized compliance requirements

- Currency and payout variations

- Instant & transparent payouts build trust.

- Gamification tools (leaderboards, badges, contests) drive engagement.

- Communication modules keep field teams aligned with goals.

- Results: lower attrition, higher productivity, and stronger performance.

On average, PayPrompt delivers:

- Reduction in payout errors (up to 90%)

- Faster payout cycles (days instead of weeks)

- Improved workforce retention

Higher productivity & collections through motivated teams

Yes. PayPrompt is built on enterprise-grade architecture:

- Scalable to handle thousands of transactions per day

- Secure with data encryption, access controls, and audit logs

Cloud-ready with redundancy and uptime guarantees

Have Questions? Let’s Talk.

Drop us your query and our team will get back to you promptly with the answers you need.